Earnings season & AI's risks and benefits

Peek of the Week

Weekly Market Commentary

November 3, 2025

The Markets

Like walking on cobblestones…

If you’ve ever walked down a road paved with cobblestones, you know the uneven surface can be challenging. Today, financial markets are paved with a variety of challenges and concerns. A recent survey from Charles Schwab found that its clients remain bullish; however, they have concerns about how the political landscape, market valuations, and geopolitical and macroeconomic issues will affect markets over the next three months. They also are considering the possibility of stagflation. (Stagflation is a rare confluence of slow economic growth, high inflation, and high unemployment.)

Last week, markets were volatile. Rising and falling in response to a variety of different events, including:

U.S.- China trade negotiations. President Donald Trump and President Xi Jinping met last week and “Both sides agreed to delay restrictions that formed the center of an escalating tit-for-tat in recent weeks. That de-escalation…took a worst-case scenario off the table for markets, though much of what was agreed upon still has to be worked out in detail,” reported Reshma Kapadia of Barron’s.

A cautionary statement from the Federal Reserve (Fed). Investors were not surprised when the Fed lowered the federal funds rate last week. However, the market wobbled when Fed Chair Jerome Powell emphasized that a December rate cut was not a certainty, reported Joe Weisenthal of Bloomberg. In the post-meeting statement, Chair Powell said:

“Available indicators suggest that economic activity has been expanding at a moderate pace. GDP rose at a 1.6 percent pace in the first half of the year, down from 2.4 percent last year…In the near term, risks to inflation are tilted to the upside and risks to employment to the downside – a challenging situation. There is no risk-free path for policy as we navigate this tension between our employment and inflation goals.”

Third quarter company performance. It’s earnings season, the time when companies tell investors how profitable they were in the previous quarter. In general, companies performed well. “In fact, this quarter marks the 6th consecutive quarter that the S&P 500 is reporting a net profit margin above the 5-year average (12.1 [percent]),” reported John Butters of FactSet.

The caveat is that many stock prices are at levels that require excellent performance. As a result, companies with earnings that were not perfect saw their share prices drop “What is more, companies aren’t getting rewarded as much for good news…FactSet said that the average price increase following a positive earnings surprise so far this quarter is just 0.3 [percent], compared with the five-year average of 0.9 [percent],” reported Paul La Monica of Barron’s.

Just as the right footwear can make walking on cobblestones easier, having a well-allocated and diversified portfolio can make navigating uncertain markets less stressful. Diversification won’t prevent losses, but it can help investors manage portfolio risk.

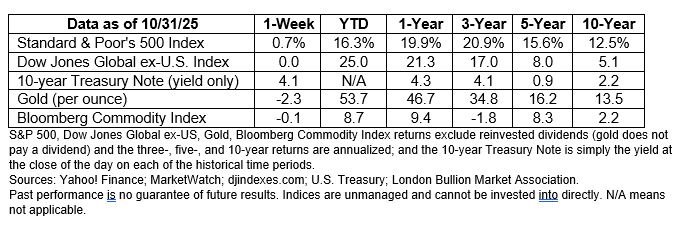

Amid significant volatility, major U.S. stock indexes moved higher over the week. Broadly speaking, U.S. Treasuries gained value as yields on many maturities ended the week lower than they started it.

WHAT IS AI GOOD FOR? Americans have mixed feelings about artificial intelligence (AI). In September, Brian Kennedy, Eileen Yam, Emma Kikuchi, Isabelle Pula, and Javier Fuentes of Pew Research reported on a September 2025 survey that asked about the risks and benefits of AI for society. The survey found:

· 50 percent of respondents were more concerned than excited about AI being used more frequently in daily life,

· 38 percent were both concerned and excited,

· 10 percent were more excited than concerned, and

· 2 percent did not respond to the question.

Regardless, many Americans are using AI to make informed decisions when buying goods and services. For example, Americans have been turning to AI for help when:

Negotiating a better price for a car. Younger generations are using AI to identify the best times to buy cars (with a focus on price fluctuations, deals, or incentives), reported Eileen Falkenberg-Hull of Newsweek. They’re also using AI to review contracts and negotiate better deals, according to The Economist.

Identifying the best value on a wine menu. Unless you are very knowledgeable about a wide range of wines, it can be challenging to know which bottle on a restaurant menu is well-priced. Now, you can upload a photo of the menu’s wine list and ask AI.

Understanding plumbing and household repair issues. AI may be able to diagnose a problem and suggest a low-cost solution or negotiate a better price with the plumber. A recent survey found that “homeowners who followed AI’s guidance…reported an average 47 [percent] reduction in repair or maintenance costs and 29 [percent] felt less stressed about managing home repairs,” reported Anna Baluch on Realtor.com. She emphasized that it is important to double-check the advice offered by AI before taking action.

“As AI goes mainstream, it will remove one of the most enduring distortions in modern capitalism: the information advantages that sellers, service providers and intermediaries enjoy over consumers. When everyone has a genius in their pocket, they will be less vulnerable to mis-selling—benefiting them and improving overall economic efficiency. The ‘rip-off economy’, in which firms profit from opacity, confusion or inertia, is meeting its match,” reported The Economist.

WEEKLY FOCUS – THINK ABOUT IT

“…an adversarial mindset not only prevents us from understanding and responding to the other party, but also makes us feel like we've lost when we don't get our way.”

–Daniel Goleman, Psychologist and author

Best regards,

Leif M Hagen, CLU, ChFC

LPL Financial Advisor

Achievement Financial

Dream. Plan. Achieve.

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Securities offered through LPL Financial, Member FINRA/SIPC.

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the “Peek of the Week” please reply to this email with “Unsubscribe” in the subject line or write us at Leif@AchievementFinancial.com.

Sources:

https://www.fidelity.com/learning-center/smart-money/stagflation

https://www.barrons.com/articles/xi-trump-china-us-cut-tariffs-chips-pause-restrictions-04bd3a99 or go to https://resources.carsongroup.com/hubfs/WMC-Source/2025/11-03-25-Barrons-XI-Trump-De-Escalate-Tensions-3.pdf

https://www.bloomberg.com/news/newsletters/2025-10-29/some-thoughts-on-today-s-fed-decision or go to https://resources.carsongroup.com/hubfs/WMC-Source/2025/11-03-25-Bloomberg-Some-Thoughts-On-Todays-4.pdf

https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20251029.pdf

https://www.barrons.com/articles/earnings-stocks-price-reactions-3a5432e6?mod=hp_LEDE_C_1 or go to https://resources.carsongroup.com/hubfs/WMC-Source/2025/11-03-25-Barrons-Wall-Street-Is-Punishing-Stocks-7.pdf

https://www.barrons.com/market-data?mod=BOL_TOPNAV or go to https://resources.carsongroup.com/hubfs/WMC-Source/2025/11-03-25-Barrons-DJIA-SP-NASDAQ-8.pdf

https://www.newsweek.com/nw-ai/gen-z-using-artificial-intelligence-ai-car-buying-timing-2047326

https://www.economist.com/finance-and-economics/2025/10/27/the-end-of-the-rip-off-economy or go to https://resources.carsongroup.com/hubfs/WMC-Source/2025/11-03-25-The-Economist-The-End-Of-The-Rip-Off-12.pdf

https://www.realtor.com/advice/home-improvement/homeowners-cut-repair-costs-using-ai/ https://www.goodreads.com/work/quotes/56127210-empathy