The implications and effects of uncertainty

Peek of the Week

Weekly Market Commentary

July 7, 2025

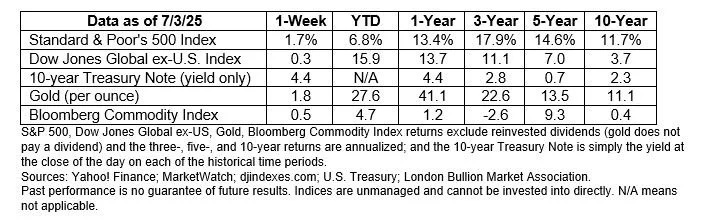

The Markets

Like riders on a giga coaster, investors experienced fear and exhilaration during the second quarter of 2025.

From April through June, investors rode markets up and down, banking through twists of news and events that had market moving potential. They swooped through the uncertain impact of tariffs on economic growth and inflation; the implications of a U.S. Treasury downgrade; the effects of fiscal policy changes in the Big Beautiful Bill; and conflicts in Ukraine and the Middle East. Here are some highlights from the quarter:

Tariff turmoil. In early April, President Trump announced tariffs on a much larger scale than anyone expected, startling investors and raising concerns about economic growth and price inflation, reported Sarah Hansen of Morningstar. The CBOE Volatility Index (VIX), which is known as Wall Street’s fear gauge, shot up to 60. (Any reading above 30 signals a high level of fear, risk, and anticipated volatility.) As the VIX rose, the stock market fell.

“The Dow shed 2,000 points in a day for the fourth time in the index's history. All told, U.S. stocks shed some $6.6 trillion in market cap in the past two days based on preliminary figures...That's the largest two-day market cap slide for U.S. listed stocks on record,” reported Connor Smith of Barron’s.

A fast recovery. President Trump delayed immediate action on tariffs, opening the door to trade negotiations. His actions reassured investors, and U.S. stocks climbed to new highs. Through last week, “The S&P 500 is up 26 [percent] from the selloff low on April 8, while the Nasdaq has surged 34.9 [percent], as the worries, from supersized tariffs to the U.S.’s artificial-intelligence dominance, have slowly faded,” reported Teresa Rivas of Barron’s.

International stocks performed even better than U.S. stocks did. “European stocks, a thoroughly unloved asset class in January, have trounced the S&P 500 by 16 percentage points in dollar terms, the biggest outperformance since 2006…After underperforming the US market every year since 2017, developing-country equities are finally winning, helped by a boom in [artificial intelligence] companies from Taiwan, South Korea and China,” reported Alice Gledhill, Malavika Kaur Makol and Sagarika Jaisinghani of Bloomberg.

Excellent earnings growth. During earnings season, companies let investors know how they performed in the previous quarter. Collectively, companies in the Standard & Poor’s (S&P) 500 Index reported earnings growth of 12.9 percent for the first quarter of 2025. It was the second consecutive quarter of double-digit earnings growth, reported John Butters of FactSet. (Earnings are a measure of profitability.)

Tariffs were the hot topic on earnings calls. They were mentioned by 427 S&P 500 companies. Some companies were concerned about tariffs. Some were not. The head of a financial firm told Sabrina Escobar of Barron’s, “The simple truth today is that we don’t yet know where trade policy will settle, nor do we know what the actual transmission effects will be on the real economy.”

The U.S. Federal Reserve (Fed) kept rates unchanged. Despite significant pressure from the administration to stimulate the economy by lowering rates, the Fed left the federal funds rate unchanged. At the end of the quarter, inflation was near the Fed’s two percent target and unemployment remained low. Both suggest the economy remains resilient.

Major U.S. stock indexes continued to move higher last week, with the S&P 500 and Nasdaq finishing the week at record highs. Yields on U.S. Treasuries moved higher last week after a stronger-than-expected employment report lowered expectations that the Fed might cut the federal funds rate in July, reported Sean Conlon, Alex Harring, and Sawdah Bhaimiya of CNBC.

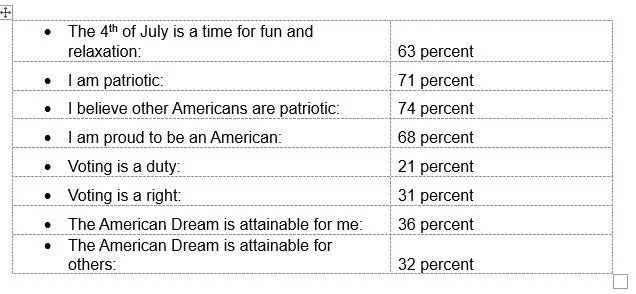

PATRIOTIC FEELINGS. Last week, Americans celebrated the Fourth of July. Independence Day has been a national holiday since 1941, but the tradition began long before that. Americans have been celebrating Independence Day since “the 18th century and the American Revolution. On July 2nd, 1776, the Continental Congress voted in favor of independence, and two days later delegates from the 13 colonies adopted the Declaration of Independence, a historic document drafted by Thomas Jefferson. From 1776 to the present day, July 4th has been celebrated as the birth of American independence, with festivities ranging from fireworks, parades and concerts to more casual family gatherings and barbecues,” according to History.com.

A recent survey asked Americans about the Fourth of July, patriotism and the American Dream. Here’s what they said:

WEEKLY FOCUS – THINK ABOUT IT

"This is your democracy. Make it. Protect it. Pass it on."

― Thurgood Marshall, Former Supreme Court Justice

Best regards,

Leif M. Hagen, CLU, ChFC

LPL Financial

Achievement Financial

Dream. Plan. Achieve.

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Securities offered through “LPL Financial”, Member FINRA/SIPC.

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the “Peek of the Week” please reply to this email with “Unsubscribe” in the subject line or write us at Leif@AchievementFinancial.com

Sources:

https://www.barrons.com/articles/stock-market-fed-rate-cuts-d0252a07?mod=Searchresults or go to https://resources.carsongroup.com/hubfs/WMC-Source/2025/07-07-25-Barrons-Stocks-Are-Flying-the-Dollar-is-Falling%20-%201.pdf

https://www.morningstar.com/markets/13-charts-q2s-major-market-rebound

https://finance.yahoo.com/news/cboe-volatility-index-vix-measured-153231819.html

https://www.cboe.com/tradable_products/vix/ [Video 1:15]

https://www.barrons.com/livecoverage/stock-market-today-040425 or go to https://resources.carsongroup.com/hubfs/WMC-Source/2025/07-07-25-Barrons-Nasdaq-Enters-Bear-Market%20-%205.pdf

https://www.barrons.com/articles/stock-market-hits-record-highs-tax-bill-jobs-6f818d48? or go to https://resources.carsongroup.com/hubfs/WMC-Source/2025/07-07-25-Barrons-Stocks-Hit-Record-Hights%20-%206.pdf

https://www.bloomberg.com/news/newsletters/2025-06-30/rollercoaster-first-half-is-ending-with-stocks-at-records or go to https://resources.carsongroup.com/hubfs/WMC-Source/2025/07-07-25-Bloomberg-Rollercoaster-First-Half-Is-Ending%20-%207.pdf

https://insight.factset.com/earnings-insight-infographic-q1-2025-by-the-numbers

https://www.barrons.com/articles/tariffs-earnings-calls-stock-ccab0e3b or go to https://resources.carsongroup.com/hubfs/WMC-Source/2025/07-07-25-Barrons-CEOs-Are-Saying-These-2-Ominous%20-%209.pdf

https://www.federalreserve.gov/newsevents/pressreleases/monetary20250618a.htm

https://www.barrons.com/market-data?mod=BOL_TOPNAV or go to https://resources.carsongroup.com/hubfs/WMC-Source/2025/07-07-25-Barrons-DJIA-S&P-Nasdaq%20-%2011.pdf

https://www.cnbc.com/2025/07/03/us-treasury-yields-investors-await-junes-big-jobs-report-.html

https://www.history.com/articles/july-4th

https://d3nkl3psvxxpe9.cloudfront.net/documents/July_Fourth_poll_results.pdf

https://www.usatoday.com/story/news/2024/06/19/patriotic-quotes-america-usa/74070993007/#