New record highs amidst ongoing economic recovery

Peek of the Week

Weekly Market Commentary

September 22, 2025

The Markets

The bulls were running.

Last week, investors rejoiced after the Federal Reserve Open Market Committee (FOMC) lowered the federal funds rate by a quarter percentage point. Major U.S. stock indexes set new record highs.

FOMC projections for the future suggested more rate cuts could be ahead. “The updated ‘dot plot’ forecasts three cuts in 2025, up from two in June, but the outlook reveals deep uncertainty among policymakers. The median forecast masks a razor-thin 10-9 split among the 19 participants, what economists call a ‘soft median’ that suggests little consensus about the path ahead, reported Nicole Goodkind of Barron’s.

During a press conference, Federal Reserve (Fed) Chair Jerome Powell explained that the rate cut was a response to extraordinary economic circumstances.

“I think you could think of this, in a way, as a risk management cut...it is such an unusual situation. Ordinarily when the labor market is weak, inflation is low; and when the labor market is strong, that’s when you got to be careful about inflation. So, we have a situation where we have two-sided risk, and that means there’s no risk-free path. And so, it’s quite a difficult situation for policymakers.”

U.S. Treasury markets were less confident than stock markets following the Fed rate cut. The yield on the benchmark 10-year Treasury note dipped below 4 percent before moving higher again, reported Martin Baccardax of Barron’s. Rates moved higher because bond investors are concerned that inflation might accelerate. Rising inflation reduces the current value of interest payments, as well as the value of invested principal.

Prospective home buyers won’t be happy about the bond market’s response. The 10-year Treasury is the benchmark for mortgage rates. “Rising 10-year yields are also an issue for the housing market, which remains stuck in low gear amid record-high prices, slow new construction and mortgage rates that keep homeowners reluctant to sell and refinance,” reported Baccardax.

Last week, major U.S. stock indexes finished higher. Treasuries were mixed, with yields on shorter maturities moving lower and yields on longer maturities moving higher.

THE ALPHABET SOUP OF ECONOMIC RECOVERY. Economists find the alphabet to be a handy tool for describing economic recoveries. For instance, there are V-shaped recoveries and U-shaped recoveries. The primary difference between the two is the length of the recession. When the economy recovers, enters another recession and recovers again, the recovery is shaped like a W. The dreaded L-shaped recovery occurs when an economy takes years to return to previous levels of growth.

Since the COVID-19 recession ended, the economic recovery in the United States has been K-shaped. One group of Americans has recovered from recession and is doing relatively well. The other has yet to recover fully from the recession. The prongs of the letter “K” represents the split in their economic experiences.

“One way to think about the post-rate-hike economy is as a bifurcation between haves and have-nots as rising underemployment, sticky inflation and higher interest rates hit lower-income households more. Small businesses have also suffered disproportionately from high interest rates and tariffs. High-income households are basically keeping the economy afloat…,” reported Edward Harrison of Bloomberg.

Last week, the FICO Credit Score Report for the second quarter of 2025 reflected the K-shaped economy. The number of people in the highest and lowest credit ranges both increased, and there were 11 percent fewer people in the mid-range. In addition, the report found:

· U.S. credit scores fell. The average credit score was two points lower than it was in the previous year, largely because of rising credit card use and a surge in missed payments as student loan delinquency reporting resumed.

· Young people were struggling. The group with the biggest decline in credit scores was 18- to 29-year-olds. This group typically has more student loan debt than older populations.

· Loan delinquencies were up.

· Auto loans were paid first. When Americans must decide what to pay first, they typically choose car loans. Next up is the mortgage, followed by credit cards and student loans.

The K-shaped economy reflects uneven economic progress since the pandemic.

WEEKLY FOCUS – THINK ABOUT IT

“Human greatness does not lie in wealth or power, but in character and goodness. People are just people, and all people have faults and shortcomings, but all of us are born with a basic goodness.”

– Anne Frank, Diarist

Best regards,

Leif M. Hagen, CLU, ChFC

LPL Financial Advisor

Achievement Financial

Dream. Plan. Achieve.

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Securities offered through LPL Financial, Member FINRA/SIPC.

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

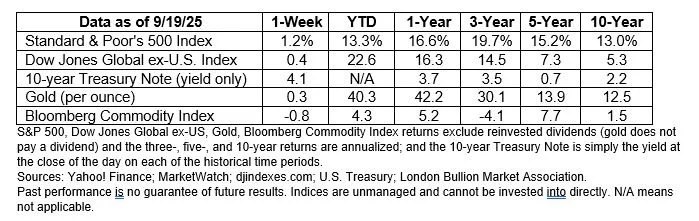

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the “Peek of the Week” please reply to this email with “Unsubscribe” in the subject line or write us at Leif@AchievementFinancial.com

Sources:

https://www.federalreserve.gov/newsevents/pressreleases/monetary20250917a.htm

https://www.barrons.com/articles/fed-september-meeting-rate-cut-977abbde or go to https://resources.carsongroup.com/hubfs/WMC-Source/2025/09-22-25-Barrons-The-Feds-Just-Trimmed-Rates-3.pdf

https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20250917.pdf [Pp. 1, 7, 11, 24]

https://www.barrons.com/articles/treasury-yields-fed-rates-stocks-b4844a34 or go to https://resources.carsongroup.com/hubfs/WMC-Source/2025/09-22-25-Barrons-Treasury-Market-Wobbles-5.pdf

https://www.barrons.com/market-data?mod=BOL_TOPNAV or go to https://resources.carsongroup.com/hubfs/WMC-Source/2025/09-22-25-Barrons-DJIA-SP-NASDAQ-6.pdf

https://en.wikipedia.org/wiki/Recession_shapes

https://www.bloomberg.com/news/newsletters/2025-09-17/the-recession-is-already-happening-for-many-americans? or go to https://resources.carsongroup.com/hubfs/WMC-Source/2025/09-22-25-Bloomberg-The-Recession-Is-Already-Happening-9.pdf

https://www.fico.com/en/resource-access/download/55026 [Pp. 4-5]

https://www.goodreads.com/quotes/7108-human-greatness-does-not-lie-in-wealth-or-power-but

Photo by Alicia Christin Gerald on Unsplash