Volatility continues during gift giving season

Peek of the Week

Weekly Market Commentary

November 24, 2025

The Markets

Uncertainty abounds.

Investors were skittish last week. Share prices jolted higher and lower amid concerns about artificial intelligence (AI) data center spending, upcoming Federal Reserve rate decisions, and the strength of consumer spending, reported Phil Serafino and Natalia Kniazhevich of Bloomberg. These issues will affect the future performance of companies, and investors are trying to anticipate what may be ahead.

In the third quarter, companies were profitable and sales were strong

Overall, U.S. companies performed well in the third quarter of 2025. So far, 95 percent of companies in the Standard & Poor’s (S&P) 500 Index have reported on performance over the period. Almost three-fourths performed better than analysts expected. Overall, company profits were up 13.4 percent for the quarter, reported John Butters of FactSet.

Sales (a.k.a. revenue) have been strong, as well. In the third quarter, S&P 500 companies had the highest combined sales growth in three years (+8.4 percent). “Three sectors are reporting (or have reported) double-digit revenue growth for the quarter: Information Technology, Health Care, and Communication Services,” reported Butters.

Share prices reflect recent performance and investors’ expectations

While strong company performance is reassuring, some analysts and asset managers believe stock prices, overall, are too high. For instance, Bank of America’s November survey of global money managers found that most respondents thought stocks were overvalued, reported Brett Arends of MarketWatch via Morningstar.

Not everyone agrees. Last week, Dan Kemp of Morningstar reported, “Strong revenue growth and unusually high profit margins…alongside the US stock market’s growing concentration in companies benefiting from the rapid growth in AI have led Morningstar’s analysts to increase their estimates of the market’s fair value. As a result, the average US company under Morningstar’s coverage now appears undervalued...”

Expect volatility to continue

While Morningstar analysts think valuations are attractive, they expect markets to remain volatile. The U.S. stock market’s “concentration in tech stocks – companies dependent on long term future growth – brings with it increased risk of lurching price movements driven by short-term changes in investor sentiment.”

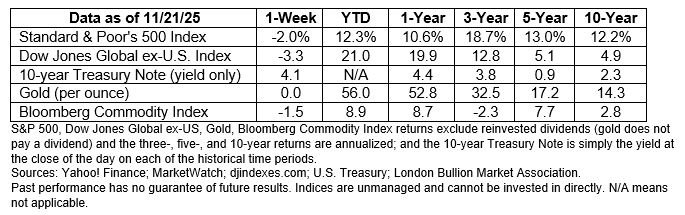

There were a lot of ups and downs last week. Major U.S. stock indices ended the week lower. In contrast, U.S. Treasuries rallied, with yields on most maturities falling.

‘TIS THE SEASON! The holiday shopping season gets underway this week, and expectations are high. The National Retail Federation (NRF) looks at a bunch of economic factors – consumer spending, disposable personal income, employment, wages, inflation, and monthly retail sales – to estimate how much people will spend over the winter holidays. This year, the forecast suggests sales will top $1 trillion.

“American consumers may be cautious in sentiment yet remain fundamentally strong and continue to drive U.S. economic activity…We remain bullish about the holiday shopping season and expect that consumers will continue to seek savings in nonessential categories to be able to spend on gifts for loved ones,” explained NRF President and CEO Matthew Shay.

The gift shift

The Currency reported on a recent survey, called the Going Rate, that explored how Americans think about gift giving and spending. When responses were tallied, it found that:

86 percent Believe gifts can be meaningful without being expensive.

75 percent Expect gifts will be more expensive this year because of tariffs and inflation.

60 percent Think gift culture has gotten “out of hand”.

58 percent Have a gift budget.

56 percent Buy gifts throughout the year to spread out the cost.

48 percent Experience gift fatigue.

33 percent Are adopting no-gift policies.

Fifty-five percent of millennials, 50 percent of Gen Z, and 28 percent of baby boomers would rather give the gift of time and shared experience. They believe their presence is the real gift. Respondents who plan to give gifts expect to spend about $64 per person, on average.

WEEKLY FOCUS – THINK ABOUT IT

“Honey, do you honestly think I would check thousands of tiny little lights if I wasn’t sure the extension cord was plugged in?”

– Clark Griswold, National Lampoon's Christmas Vacation

Best regards,

Leif M. Hagen, CLU, ChFC

LPL Financial Advisor

Achievement Financial

Dream. Plan. Achieve.

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Securities offered through LPL Financial, Member FINRA/SIPC.

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the “Peek of the Week” please reply to this email with “Unsubscribe” in the subject line or write us at Leif@AchievementFinancial.com

Sources:

https://www.bloomberg.com/news/newsletters/2025-11-21/investors-angst-goes-far-beyond-ai-and-nvidia? or go to https://resources.carsongroup.com/hubfs/WMC-Source/2025/11-24-25-Bloomberg-Investors-Angst%20-%201.pdf

https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_112125.pdf or go to https://resources.carsongroup.com/hubfs/WMC-Source/2025/11-24-25-Factset-Earnings-Insight%20-%202.pdf

https://www.barrons.com/market-data?mod=BOL_TOPNAV or go to https://resources.carsongroup.com/hubfs/WMC-Source/2025/11-24-25-Barrons-DJIA-S&P-Nasdaq%20-%205.pdf

https://www.empower.com/the-currency/money/going-rate-research

https://www.today.com/life/holidays/christmas-vacation-quotes-rcna48344