When bad news is good and keeping unemployment low

Peek of the Week

Weekly Market Commentary

September 8, 2025

The Markets

Was the jobs report good news or bad news for the stock market?

In financial markets, sometimes bad news is good. It looked like that might be the case last week. On Friday, the Employment Situation Summary was released. It showed U.S. businesses added just 22,000 jobs in August – well below expectations. Economists polled by Reuters had predicted 75,000 new jobs would be added. The unemployment rate ticked higher, moving from 4.2 percent to 4.3 percent.

That was not good news for American workers. “The [employment data] will likely heighten concerns about the durability of the labor market…Accounting for the revisions in this report, employment growth in the last three months has averaged just 29,000. Payrolls have come in under 100,000 for four straight months, extending the weakest stretch of job growth since the pandemic,” reported Molly Smith of Bloomberg.

At first, investors celebrated, and U.S. stocks moved higher. The bad news was good news because it increased the likelihood the Federal Reserve (Fed) would lower the federal funds rate at its next meeting. When the Fed lowers the federal funds rate, rates on credit cards, home equity loans, and other types of loans typically move lower, too. Low rates inspire more spending and make it cheaper to borrow, which can stimulate economic growth and lift stock prices.

As investors considered what a less robust job market might mean for economic growth, sentiment shifted. “Strong evidence the U.S. labor market is slowing rippled through Wall Street, driving stocks lower and bonds higher on concern the Federal Reserve will now have to rush to prevent further weakness. The sharp cooling triggered fears about a more pronounced jobs slowdown, sparking a flight to Treasuries, with two-year yields hitting the lowest level since 2022,” explained Rita Nazareth of Bloomberg.

Investors may have recalled a late-August speech in which Fed Chair Jerome Powell noted the U.S. labor market was in a “curious kind of balance” due to “a marked slowing in both the supply of and demand for workers. This unusual situation suggests that downside risks to employment are rising. And if those risks materialize, they can do so quickly in the form of sharply higher layoffs and rising unemployment.”

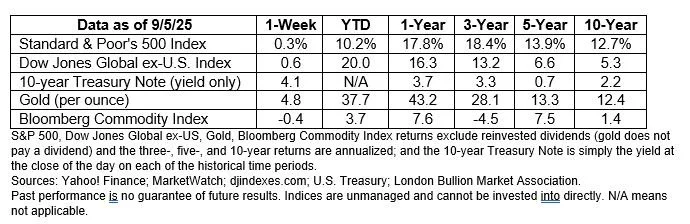

The Standard & Poor’s 500 and Nasdaq Composite Indexes gained over the week, despite dipping lower on Friday. The Dow Jones Industrial Average finished the week lower. Treasury yields fell across all maturities.

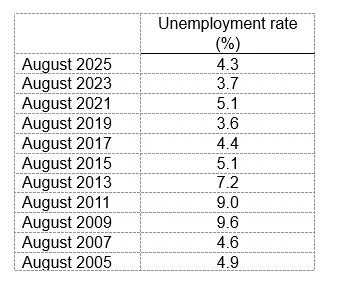

HOW MANY NEW JOBS DOES THE U.S. NEED TO KEEP UNEMPLOYMENT LOW? Over the past two decades, the unemployment rate in the United States has varied greatly. It spiked following the 2008 financial crisis (rising to 10 percent in October 2009) and again during the Covid-19 pandemic (rising to 14.8 percent in April 2020).

Since late 2021, though, the unemployment rate has remained relatively low – hovering around four percent. From an economic perspective, that puts the U.S. at or near maximum employment. In general, the maximum employment rate for the U.S. is estimated to be 3.5 percent to 4.5 percent, according to Marios Karabarbounis of the Federal Reserve Bank of Richmond.

The number of new jobs needed to keep employment steady is called the “breakeven employment growth rate”. In January, Victoria Gregory and Alexander Bick of the Federal Reserve Bank of St. Louis estimated that about 150,000 new jobs were needed each month to maintain a stable employment rate.

Since the start of this year, immigration has fallen dramatically – and so has the estimate of the number of new jobs needed to keep the employment rate steady. That’s because “…the biggest swing factor in the breakeven growth rate is the population growth rate.” With population numbers falling, just 32,000 to 82,000 jobs are needed each month to keep employment at the current level.

WEEKLY FOCUS – THINK ABOUT IT

“Far and away the best prize that life offers is the chance to work hard at work worth doing.”

– Theodore Roosevelt, Former U.S. President

Best regards,

Leif M. Hagen, CLU, ChFC

LPL Financial Advisor

Achievement Financial

Dream. Plan. Achieve.

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Securities offered through LPL Financial, Member FINRA/SIPC.

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the “Peek of the Week” please reply to this email with “Unsubscribe” in the subject line or write us at Leif@AchievementFinancial.com

Sources:

https://www.bls.gov/news.release/empsit.nr0.htm

https://www.reuters.com/business/instant-view-us-job-growth-slows-sharply-august-unemployment-rate-ticks-higher-2025-09-05/ or go to https://resources.carsongroup.com/hubfs/WMC-Source/2025/09-08-25-Reuters-Instant-View-US-Job.pdf

https://www.bloomberg.com/news/articles/2025-09-05/us-employers-add-just-22-000-jobs-unemployment-rate-rises or go to https://resources.carsongroup.com/hubfs/WMC-Source/2025/09-08-25-Bloomberg-Weak-US-Payroll-3.pdf

https://www.investopedia.com/articles/investing/010616/impact-fed-interest-rate-hike.asp https://www.bloomberg.com/news/articles/2025-09-04/stock-market-today-dow-s-p-live-updates?srnd=undefined or go to https://resources.carsongroup.com/hubfs/WMC-Source/2025/09-08-25-Bloomberg-Stocks-Fall-As-Bleak.pdf

https://www.federalreserve.gov/newsevents/speech/powell20250822a.htm

https://www.barrons.com/market-data?mod=BOL_TOPNAV or go to https://resources.carsongroup.com/hubfs/WMC-Source/2025/09-08-25-Barrons-DJIA-SP-NASDAQ.pdf

https://www.bls.gov/charts/employment-situation/civilian-unemployment-rate.htm https://www.richmondfed.org/publications/research/economic_brief/2025/eb_25-32

https://www.goodreads.com/quotes/tag/labor